Sensor Market in 2026: In-depth Analysis of 10 Market-Leading Companies

Feb 04, 2026By 2026, the temperature sensor market will no longer be just about components. The choice of sensor has become a core engineering decision that affects system performance, stability, and lifecycle cost.

This guide takes both engineering and procurement perspectives, combining authoritative market data, technical comparison matrices, and practical frameworks to help technical teams and purchasing leaders make scientific and defensible decisions.

All industry data cited in this article is marked with [Data Source: 2026 Industry Baseline].

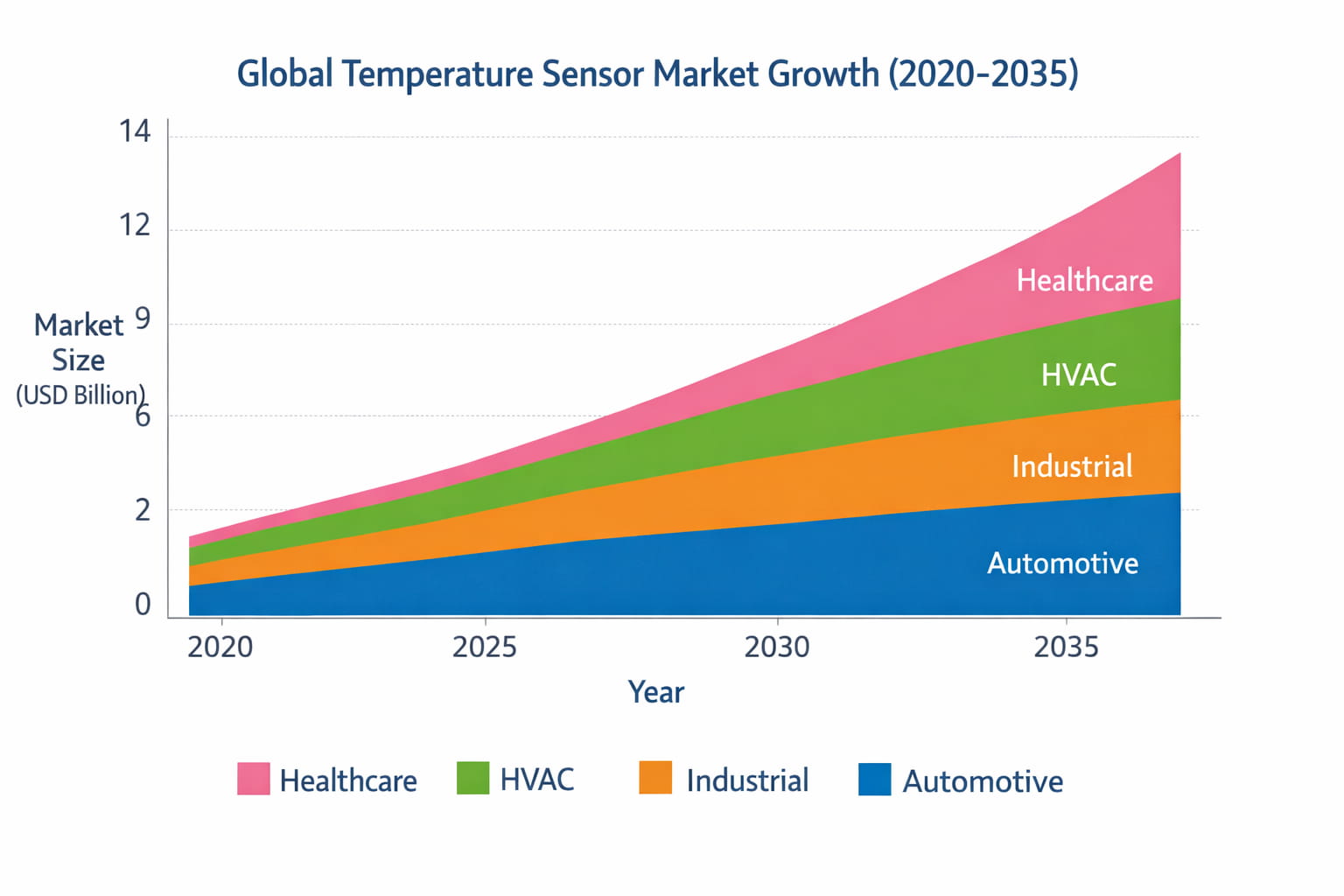

The global temperature sensor market continues to expand. According to industry forecasts, the market size is expected to reach around USD 7.88 billion by 2026, driven by adoption in HVAC, industrial automation, automotive thermal systems, and healthcare monitoring. [Data Source: 2026 Industry Baseline]

This growth is not simply volume growth. Systems are increasingly demanding higher measurement precision, long-term reliability, and environmental durability from temperature sensors.

For engineering teams, this means considering not only initial accuracy but also long-term drift, environmental robustness, communication compatibility, and certification readiness.

Industrial automation and Industry 4.0 require precise and reliable temperature data for process control and predictive maintenance, where temperature drift can directly affect production quality and safety.

Electric vehicles (EVs) have elevated thermal management requirements. Battery thermal behavior directly impacts safety, performance, and lifecycle. Accurate temperature sensing is critical to achieving efficient and safe EV operation.

Building energy efficiency and automation systems (HVAC/BAS) require finer control of zone temperature to optimize energy usage and enhance occupant comfort.

Healthcare and pharmaceutical applications demand stringent regulatory compliance and data traceability for temperature-dependent processes such as cold chain logistics and medical device operation.

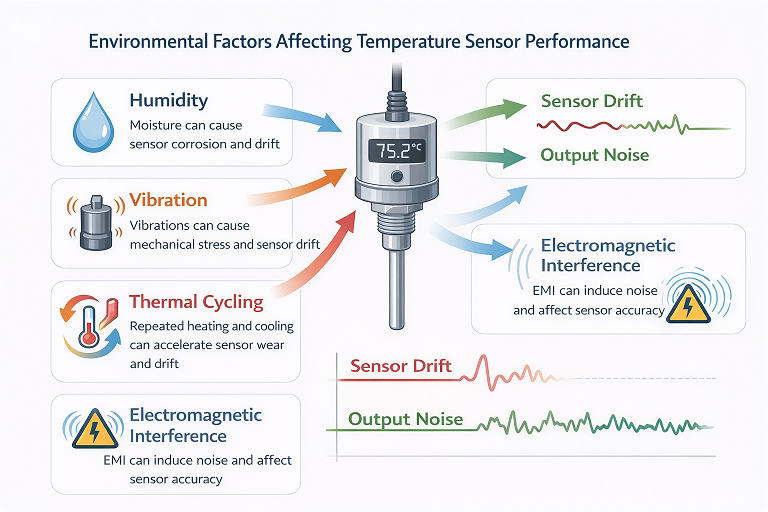

Temperature sensor performance is affected by environmental factors such as humidity, vibration, and thermal cycling. These variables can induce drift that is rarely captured by simple datasheet specifications.

Fragmentation in communication protocols (Modbus, CAN, HART, etc.) adds complexity to integration, while certification and verification requirements add time and cost to product development cycles.

Below is a comparison of major temperature sensor suppliers from an engineering practical perspective, focusing on performance stability, drift control, environmental adaptation, customization support, and certification readiness.

| Supplier | Core Strength | Main Device Types | Stability | Drift Control | Key Applications | Customization Support | Potential Limitations |

|---|---|---|---|---|---|---|---|

| Bosch | Automotive-scale production | MEMS/IC sensors | High | High | Automotive/Vehicle systems | Medium | Limited flexibility for HVAC |

| Siemens | Industrial integration | RTD/Industrial probes | High | High | Factory automation | Medium | Higher cost |

| Honeywell | Protective-grade reliability | RTD/Combined sensors | High | High | Aerospace/Industrial | Medium | Cost premium |

| Sensata | Safety & thermal protection | Thermistors/Thermocouples | High | High | Critical systems | Medium | Higher integration cost |

| STMicroelectronics | Low-cost embedded solutions | IC temperature sensors | Medium | Medium | Embedded electronics | Low | Weaker humidity tolerance |

| NXP | Automotive electronics ecosystem | Digital temperature ICs | Medium | Medium | Vehicle ECU platforms | Low | Less industrial customization |

| Keyence | Automation solutions | Industrial sensors | High | High | Factory automation | Medium | System lock-in |

| TE Connectivity | System-level integration | Various sensor types | High | High | Industrial/Energy | High | High cost |

| Amphenol | Comprehensive reliability | RTD/thermistors | High | High | Industrial/Automotive | Medium | Lower brand visibility |

| Focusens | Engineering and application-driven optimization | NTC/PTC and probes | High | High | HVAC, BMS, Industrial | High | Not mass consumer |

Many reports emphasize overall market size and CAGR, but for real engineering applications, the critical factors are how the sensor behaves in operating environments, not just the brand. Some large suppliers might outperform in volume automotive deployments but lack flexibility in HVAC or industrial contexts where humidity and temperature cycling are more demanding.

The value for engineering teams lies in suppliers that provide long-term drift data, environmental durability testing, and application-level documentation — not just initial accuracy figures on a datasheet. Therefore, when choosing a supplier for building automation systems (BAS) or battery management systems (BMS), the practical behavior under actual conditions outweighs brand recognition.

“Drift” is not a single numeric value; it is a function of time and environmental stress. In real-world use, temperature sensors undergo thermal cycling, humidity changes, and mechanical vibration, which can cause output deviation over time.

Field evidence and accelerated testing show that under humidity cycling conditions, some thermistors can exhibit drift exceeding typical published values, leading to control system instability if not accounted for. This issue is especially critical in HVAC and battery management applications. [Data Source: 2026 Industry Baseline]

Effective engineering evaluation should include long-term drift tests, humidity aging, and thermal shock simulations. These go beyond datasheet numbers and help determine suitability for long-term deployment.

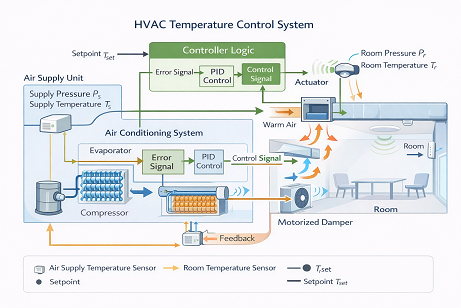

In HVAC and building automation systems, temperature readings are not just for monitoring — they feed directly into control loops that regulate heating, ventilation, and air conditioning. Misreadings due to drift or poor environmental tuning can lead to inefficient energy use and discomfort.

Industry analyses suggest HVAC demand for temperature control precision often requires sensor performance within ±0.3°C, and long-term drift beyond ±1°C can trigger unstable control behavior.

In industrial environments, mechanical and electrical noise, vibration, and thermal shocks are commonplace. Sensors used in these contexts must exhibit low noise, stable output under disturbance, and predictable aging behavior.

Key engineering considerations include:

Although initial accuracy matters, these extended performance parameters often dictate system reliability in production environments.

For engineering and procurement teams, a repeatable selection framework can greatly reduce risk:

As the global temperature sensor market grows and diversifies, choosing a temperature sensor is no longer a matter of picking a large supplier or lowest price. Real engineering success depends on factors such as long-term stability, environmental adaptation, certification support, and system-level integration fit.

A rigorous selection process based on real-world test data and environmental considerations will yield more reliable and maintainable systems than decisions driven by market rankings alone.